- #Your monthly budget should include how to

- #Your monthly budget should include update

- #Your monthly budget should include trial

- #Your monthly budget should include free

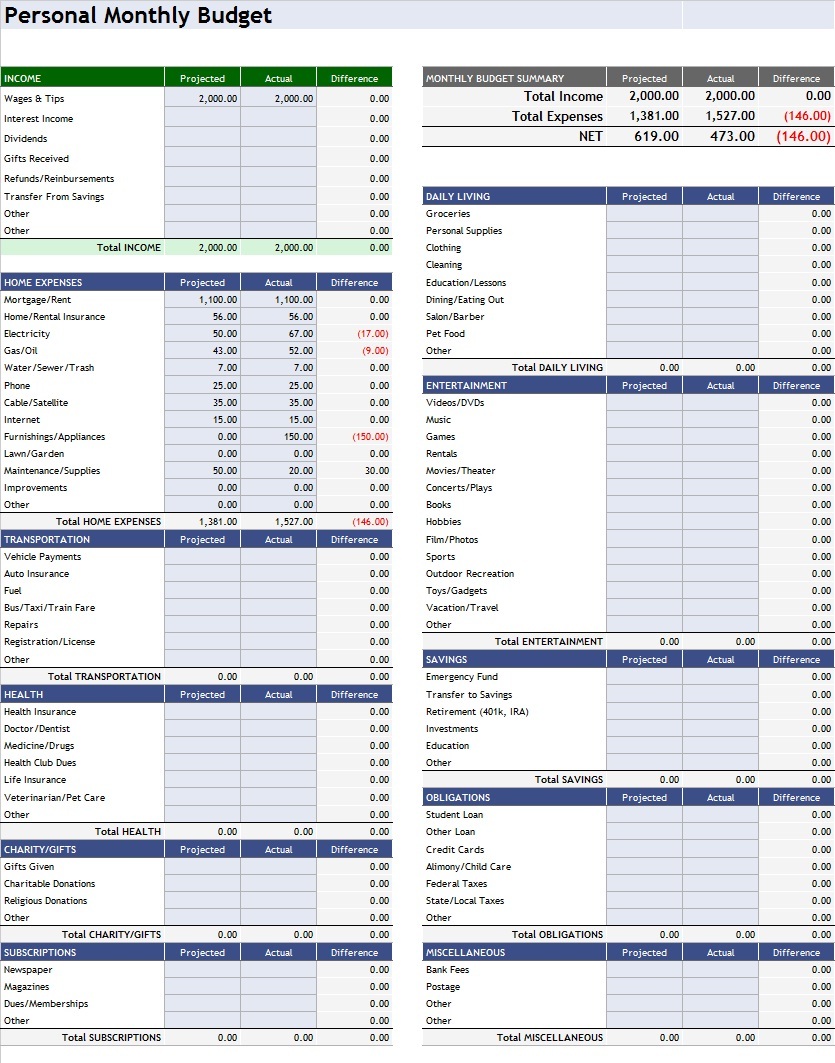

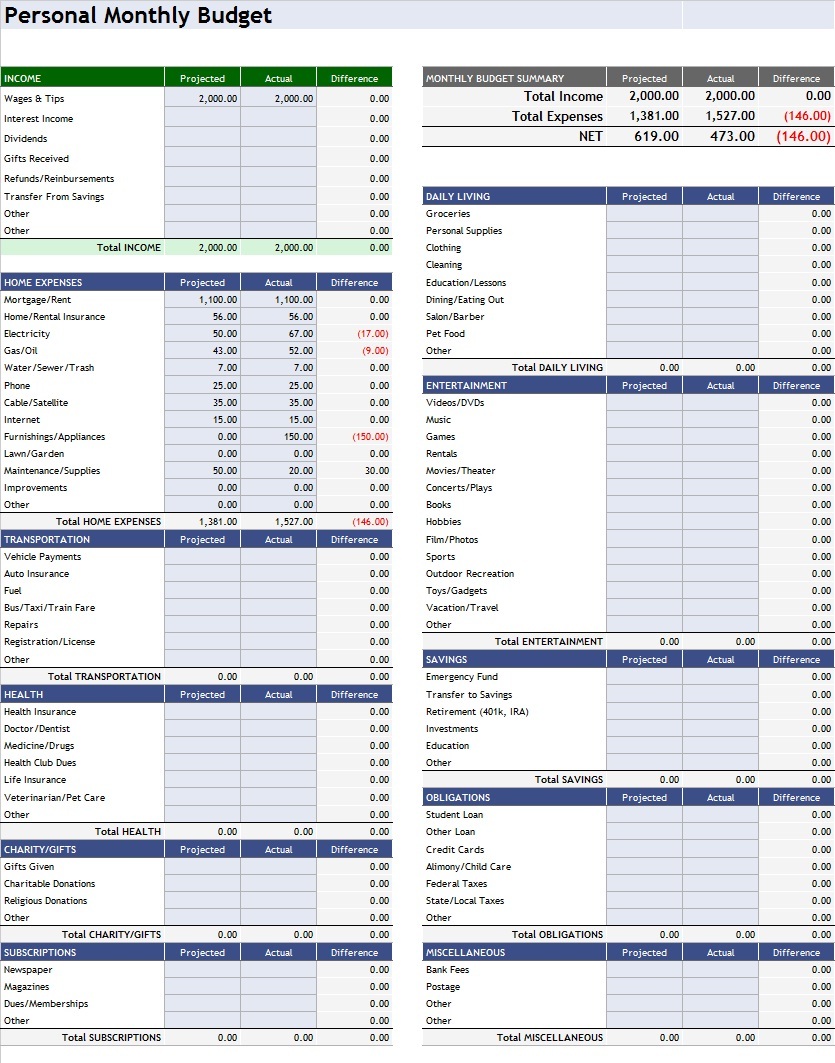

Total these expenses and divide by 12 to determine how much to budget each month so you have funds ready when you need them.

Insurance premiums, such as car or homeowners insurance. They might vary in amount and frequency, but still need to be taken into account when creating a budget. Non-monthly expenses are irregular or infrequent expenses that do not occur on a monthly basis. Tiller Tip: The Category Tracker Report for Google Sheets or Microsoft Excel can help you drill into your expenses and see totals by month or another custom period. For example:Īdd these up, then divide this number by 12 so that you can allocate a monthly amount to these expenses. Total your fixed monthly expensesįixed monthly expenses reoccur each month and are typically the same amount. Alternatively, if you track multiple categories of income and don’t want to create an income group, you could tag all income with a single “income” tag. 💡 Tiller Tip: You can categorize all of your monthly income into a single category or category group. If you have irregular income or receive payments at different times throughout the year, consider taking an average of your income over the past few months to get an estimate. All other sources of revenue such as investment dividends. Start by adding up all of your monthly take-home income (after taxes and withholdings) into a single number. #Your monthly budget should include trial

You can cancel your Tiller trial before it ends without being charged.Īlternatively, you can manually import bank CSV files into a Google Spreadsheet. This makes building your budget much faster and easier.

#Your monthly budget should include free

If you’re not using Tiller, you can sign up for a free 30-day trial and import up to 3 months (sometimes more) of your past transactions. If you’re already using Tiller, your spending and income is already organized in your Google or Excel spreadsheets. Gather several months of your finances into one dashboardīefore you can determine your One Number Budget, you’ll need to know your past spending and income trends.

#Your monthly budget should include how to

Track Your Daily Spending on a Monthly Budget Calendar How to create a One-Number Budget 1. “The reason this approach works so well for so many people is because it’s super straightforward - the idea is to calculate how much money you can afford to spend on “flexible costs” (aka the things that you have to make decisions about) each week, and then you only have to remember that one number on a day-to-day basis.” – Sofia Figueroa

You’re better prepared for unexpected expenses. You always have enough to cover your monthly fixed expenses. You can easily adjust your spending habits without having to constantly track multiple categories or budgets. One clear number avoids confusion with traditional budgeting methods. The One-Number Budget has several benefits, especially for those new to budgeting or looking for an easier way to manage their money: Benefits of the One Number Budget Approach You can estimate your One-Number Budget with this simple spreadsheet calculator. This differs from other budgeting methods that require detailed tracking of every expense.įixed monthly expenses + Average non-monthly expenses + Financial goals – Total monthly income ÷ 4.3 = Your total weekly One-Budget Number for discretionary spending The One-Number Budget simplifies the process of managing your money by focusing on one key number – your weekly spending limit. Tiller is an excellent tool for following the One Number Budget approach, because it imports data from all your financial accounts into one spreadsheet and features customizable categories, tags, and groups. Unfortunately, I lack the technical know-how to build this sheet myself.” Ultimately, I want to have a running total that shows how much discretionary spending I have left each month.

I also want to include my savings and debt payoff goals in the fixed expense category.

#Your monthly budget should include update

I aim to create a list of all my fixed expenses, which will update automatically once they’ve been paid from my account. My plan is to use the Category tab to divide my expenses into Fixed and Variable categories. I have attempted to use the Spending Money sheet, but it doesn’t work as I want it to. “I am trying to create a sheet that functions as a One Number Budget. Over in the Tiller Community, a member asked about using the One-Number Budget in a spreadsheet:

0 kommentar(er)

0 kommentar(er)